📝 My Role

Product Manager

Product Designer

👥 Teams

Marketing Team

Data Team

Design Team

Engineering Team

QA Team

🔑 Featured Solutions

1. Risk Assessment

This feature allow users to complete a short quiz and provides a customized portfolio solution based on their investment habits.

2. Customized Investment with Quick Start

The app features a simple tool for users to decided how much they are suggested to put as recurring investments based on their income level. To skip customization, users can also "quick start" with 3 popular input amount or input any value they want to invest.

3. Investment Dashboard

The investment dashboard allows users to easily understand their investments. It is consists by 5 big sections including:

Investment Overview: total investment amount, total earning and ROI

Investment chart

My portfolio: a list of investing products with category view that allow users to know which category are the most profitable

My investment preference: risk tolerant level and investment type

Recent transactions

Investment Plan: recurring investment amount and payment schedule

Notification: the most recent notification

Users are also able to access Investment and Setting tabs on the side bar; Notification, Profile and Transfer fund on the upper right corner.

0. PROJECT ROADMAP

1. RESEARCH

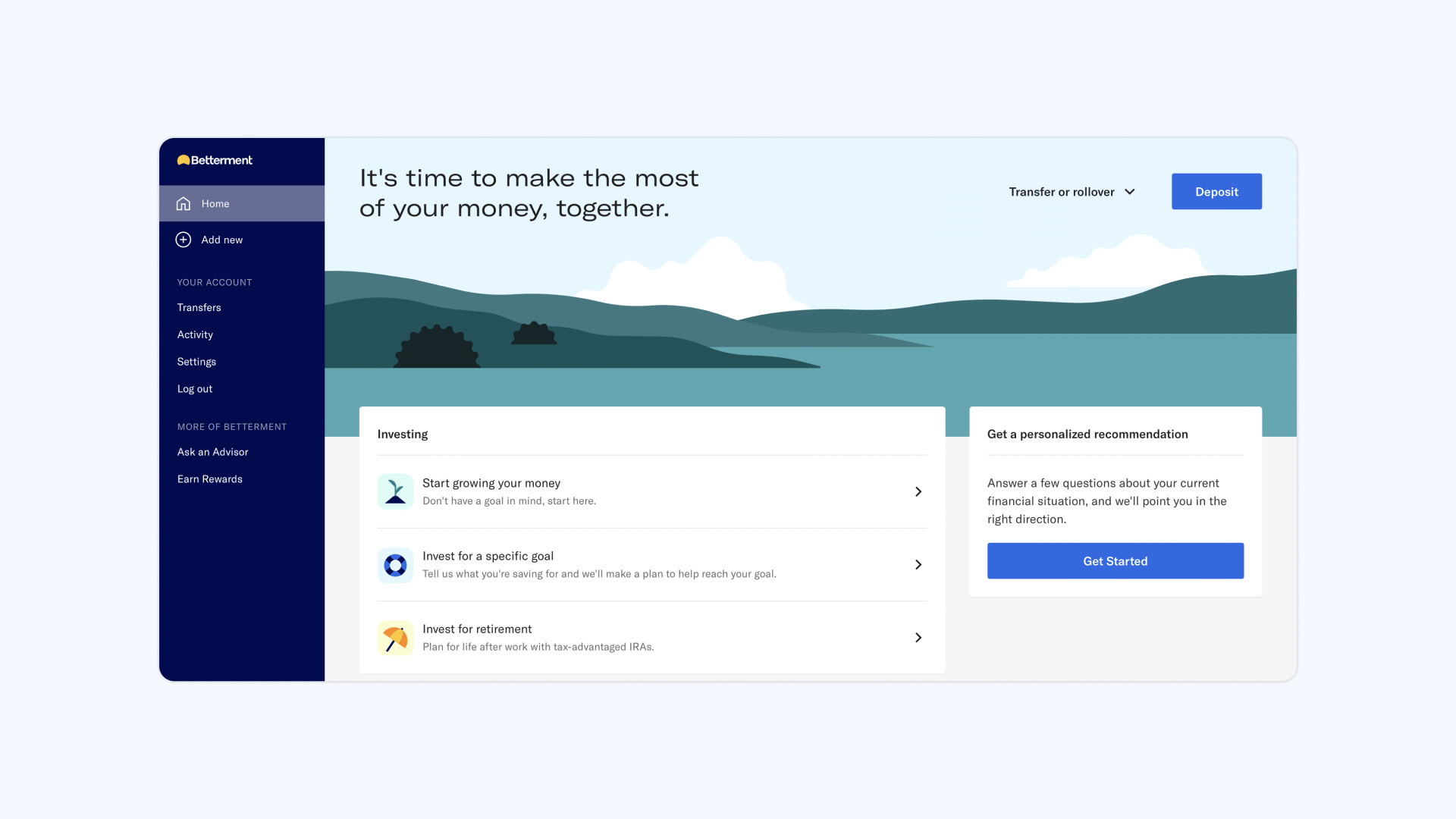

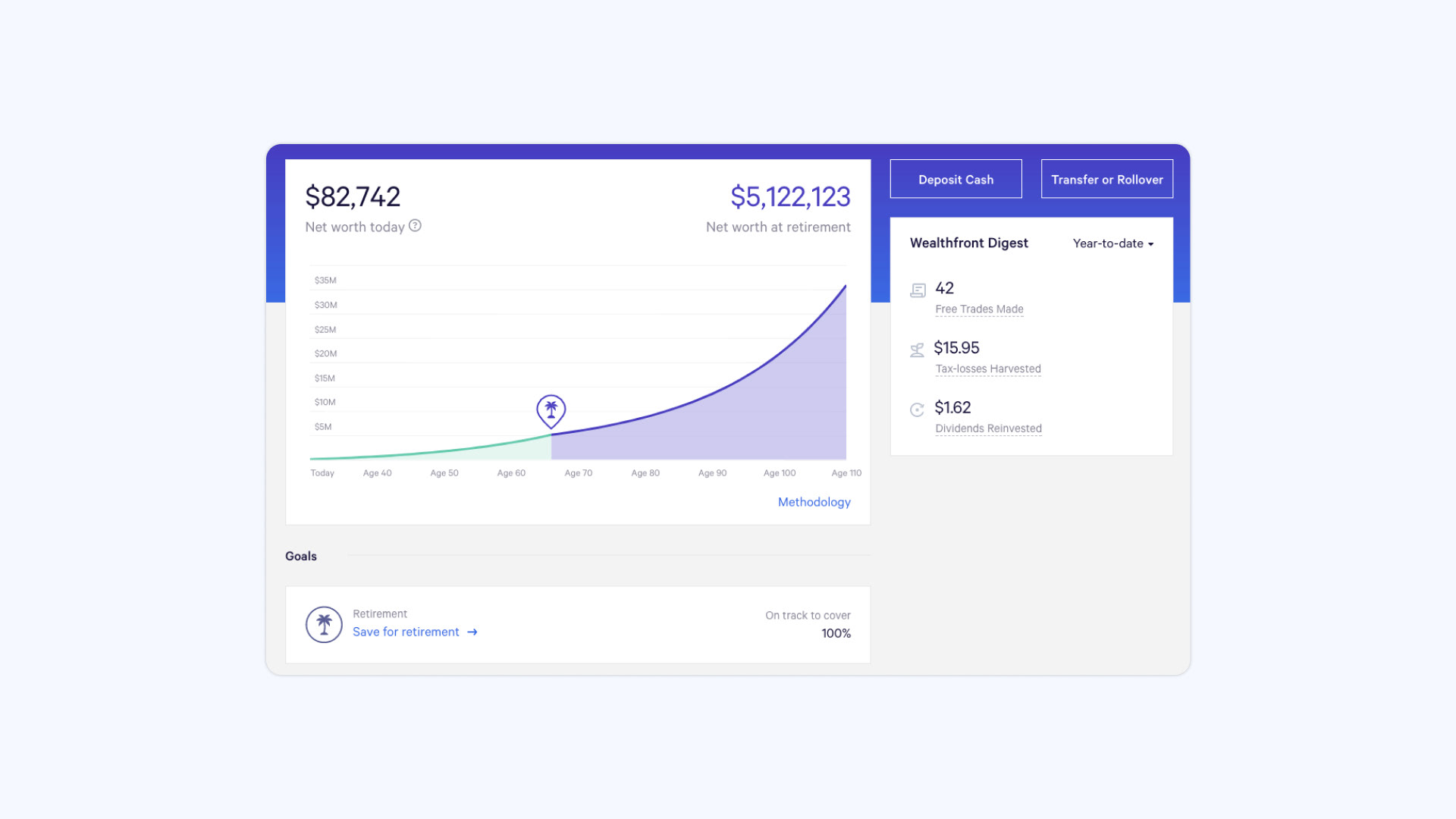

1.1 Competitor analysis

The goal was to roughly understand users' pinpoints with finances and some existing solutions. We started with questions including:

• What are some existing solution that helps freelancer to save money for future?

• What are user feedbacks from the existing products? Features they like? Features they don't like?

• What are some blockers that freelancer currently have on opening a retirement investment account?

We also looked into some existing retirement investment products:

Betterment

Wealthfront

1.2 User interview

At the same time, we worked with clients' team to conduct 1-hour interview with 10 target users on questions related to lifestyle, financial habits, etc., to identify our customer's needs and wants from their behaviors.

🔍 Key insights

• Awareness: Although they have tax saving needs, most of interviewer are unaware of the tax saving benefit of retirement investment and it's return potential

• Misconception: They think the return of retirement investment are low so that they reluctant to open an account. Instead, they choose other investment options such as stock

• Cost: High cost in accessing personalized tax planing advice

• Decision-fatigue: There are a lot of recommendations and scattered information that makes them hard to get actionable insight to make decisions

• Lack of Liquidity: The lack of liquidity cause hesitation

• Complex Onboarding Process: The traditional onboarding process for setting up IRA account is complex and time consuming, which cause delay execution

💡 Opportunity Areas

• User experience: Provide simple process to set up the IRA account and easy user experience to navigate within the app

• Budget & investment planning: Help users understand their investment needs and personalize planning based on it

• Awareness: Elevate customers' awareness of tax saving benefits and large return potential of retirement investment, by providing educational marketing on marketing side

2. CONCEPT

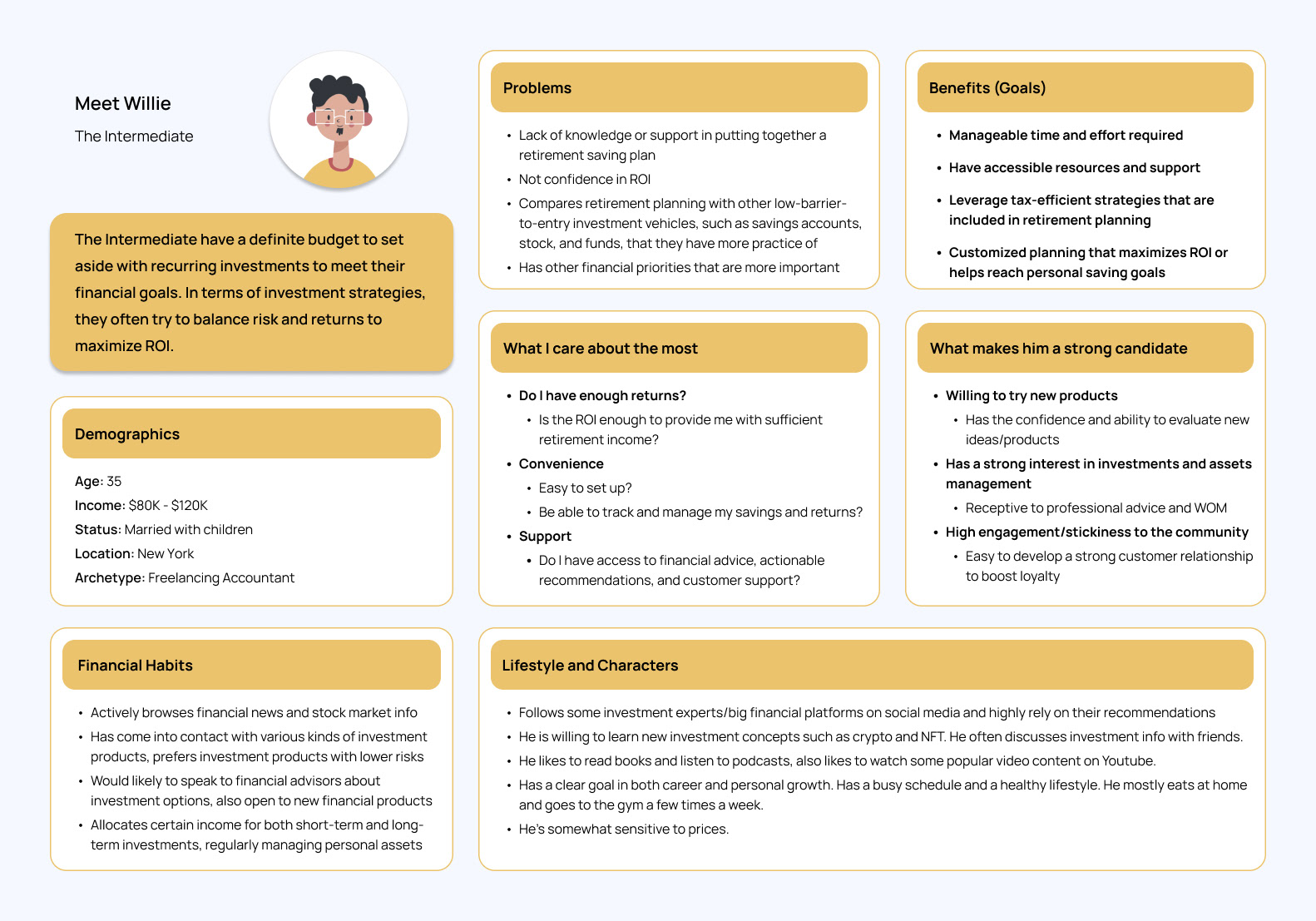

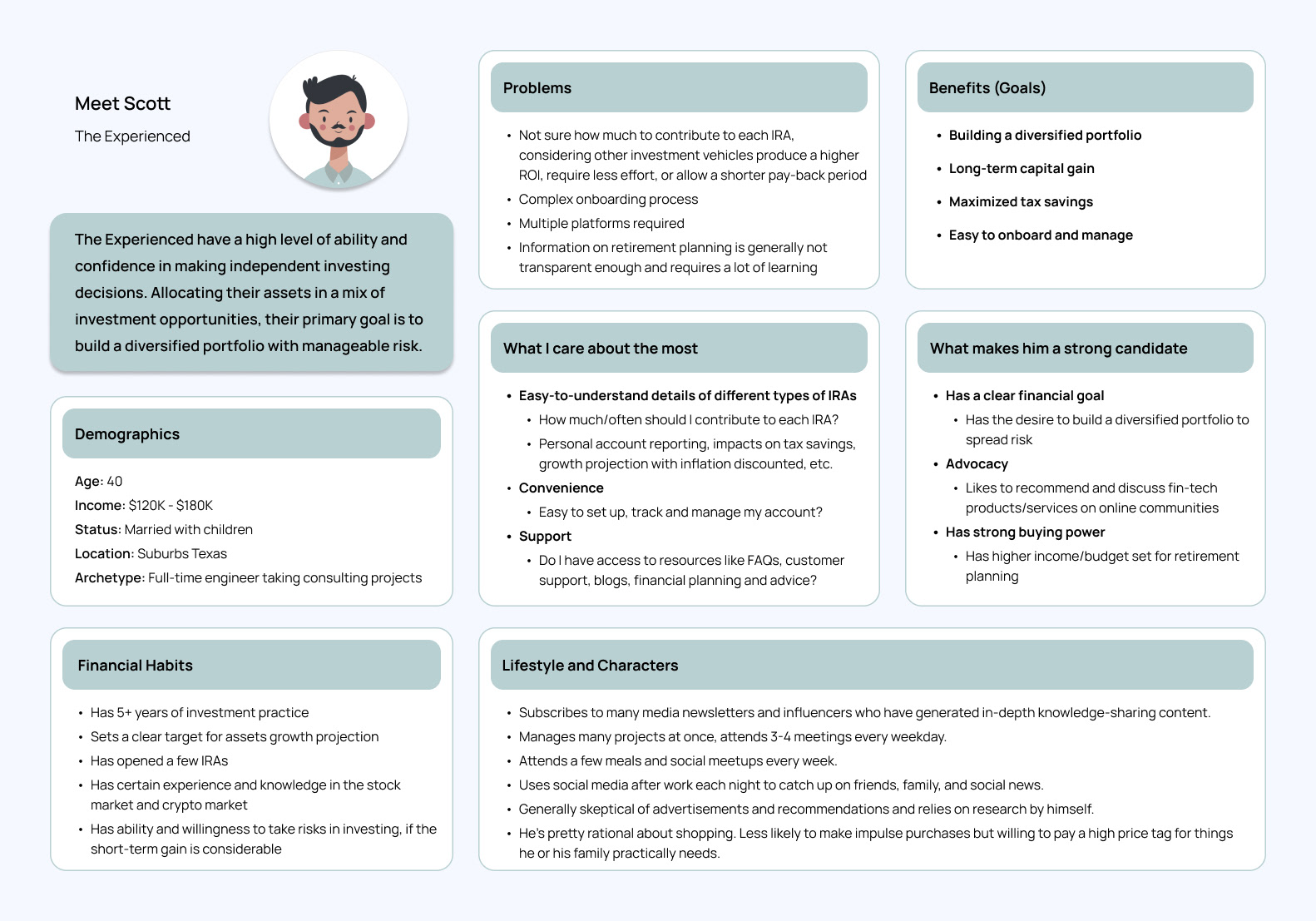

2.1 Personas

To better identify our target users and understand their needs, we created 3 personas (2 primary personas and 1 secondary personas) based on the findings from interviews and market research, as narrative information for further discussion on product features.

Jennifer - Persona

Willie - Persons

Scott - Persona

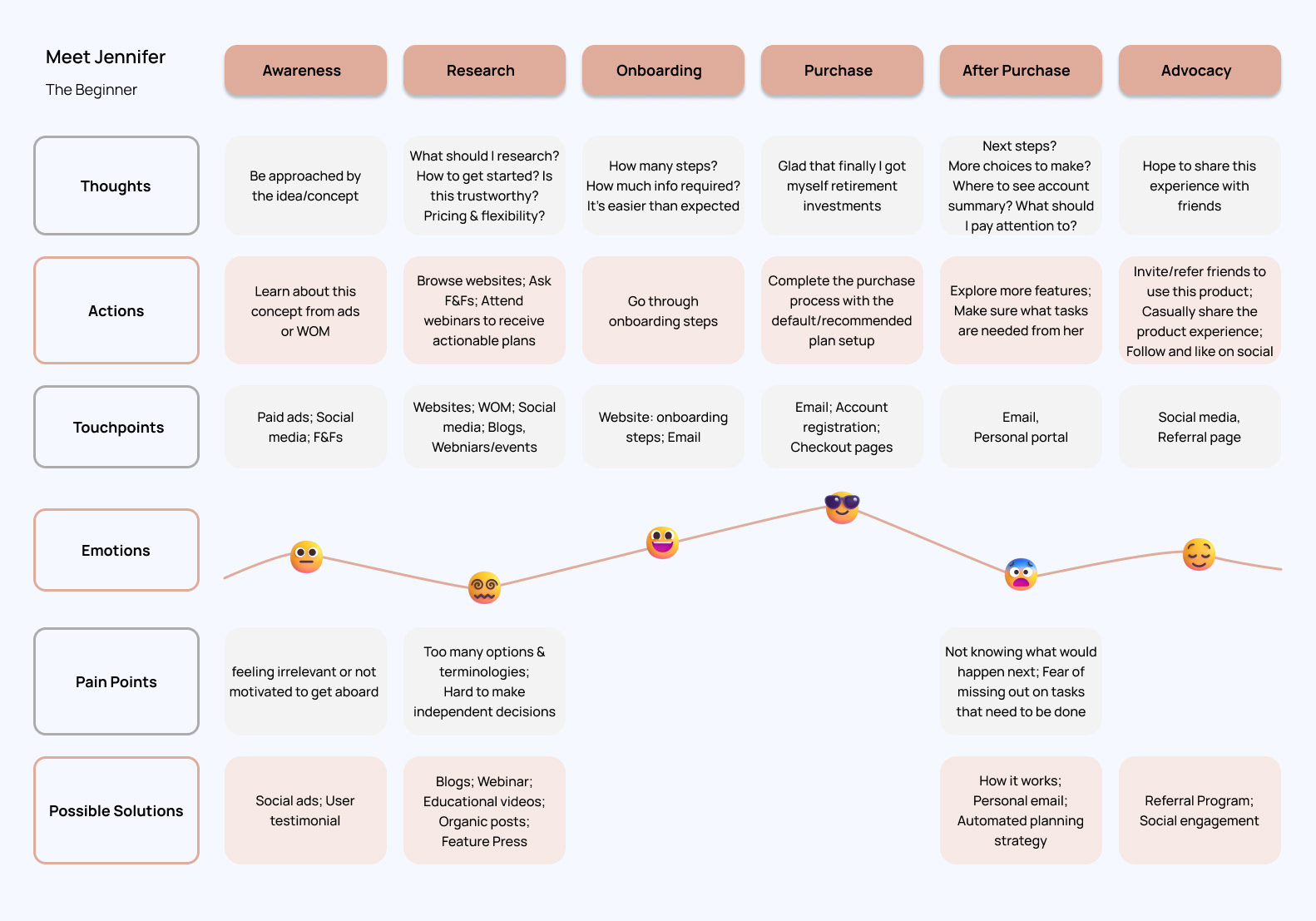

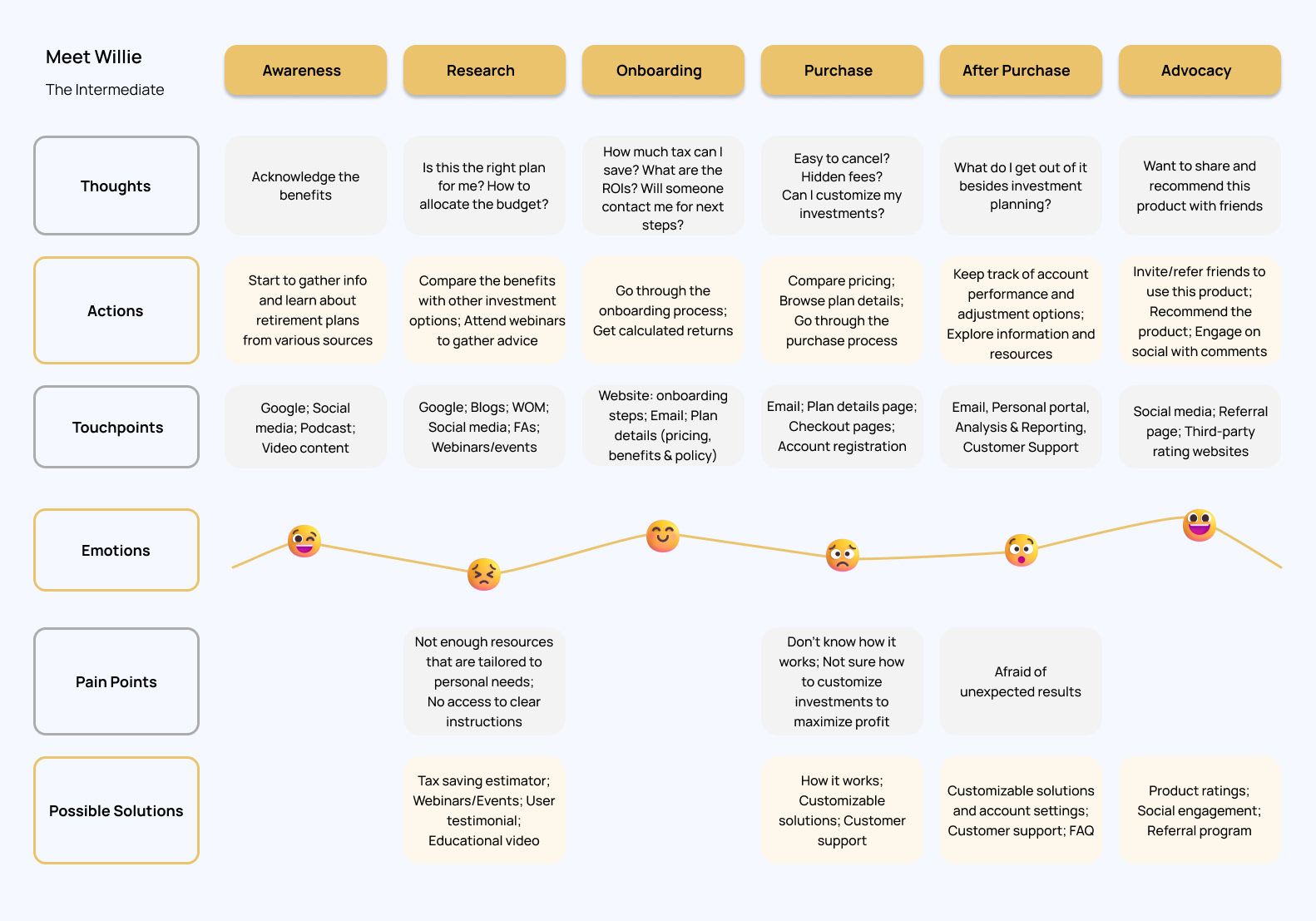

2.2 User Journey

To better understand how users would interactive with persona with pain points and emotions throughout different touchpoint, we designed three user journeys that corresponds to each persona. After discuss about our current financial offers and technical capabilities, we decided to focus on Jennifer - the beginner and Willie - the intermediate as our primary personas as they are relatively easy to acquire and we aims to provide easier experience and customized service to solve their main pain points.

2.3 Feature Backlog & Scoping MVP

After feature brainstorm with several teams, we have 20+ features on the backlog. We were able to prioritize and scoped MVP feature, by evaluating business impact vs. engineering effort, to meet our initial launch date and budget.

💻 MVP Feature List

Key features:

1. Investment tracking dashboard

2. Customized investment plan

3. Budget recommendation

4. Risk Assessment

5. Transaction

Other basic features including: notification, settings, profile, etc.

3. Design

3.1 User Flow

Moving into the design process, we mapped out the entire user flow and created a high-fidelity wireframe to understand and communicate the structure and functions, collaborated closely with the Design team.

3.2 Wireframes

3.3 Color Palette & Typography

3.5 Prototype

We have spent a week on usability testing with 10+ potentials users to test out any usability problems, finalize our design and ensure users' satisfaction.

✅ MVP - v1.0

We are currently working closely with Engineering team to develop this MVP version. After the implementation, we will have a QA round, launch with a small group of users and gradually roll out to the public.